Trial Balance Secrets That Can Transform Your Business

Understanding Trial Balance: The Foundation of Financial Clarity

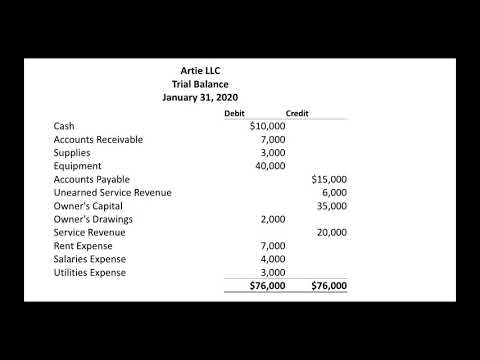

A trial balance is more than just a financial statement; it’s a roadmap that businesses use to ensure that their accounting entries are balanced. Every company, whether a small indie film studio or a large entertainment conglomerate, relies on this tool to ensure financial clarity. In 2024, with the ever-increasing challenges and competition within various industries, grasping the secrets of trial balance isn’t just advantageous—it’s essential for a true financial makeover.

The trial balance acts as a stepping stone in the preparation of financial statements. It offers businesses crucial insights into their financial health and operational efficiency. However, many organizations overlook its profound impact. Without a clear understanding and application of trial balance strategies, businesses risk falling behind their competitors in an atmosphere teeming with complexity and rapid change.

7 Game-Changing Trial Balance Strategies That Can Enhance Your Business Operations

1. Leverage Technology for Real-Time Data Access

It’s 2024, and if you’re still relying solely on manual bookkeeping, it’s high time to rethink your approach. Modern accounting solutions like Xero and QuickBooks allow businesses instant access to their trial balance. This real-time data access empowers companies to make informed decisions at a moment’s notice.

With accurate and timely information, you can sidestep common pitfalls like errors from manual data entry. The time saved here can greatly enhance productivity, allowing you to focus on growth rather than paperwork.

2. Understand the Importance of Shot Stock

Have you ever considered how surplus inventory can impact your trial balance? Shot stock, or excess inventory held for anticipated future sales, can significantly affect your financial picture. Integrating these costs into your trial balance can pinpoint areas where you’re tying up unnecessary capital.

For instance, an indie film studio that produces seasonal merchandise, like a Buzz Lightyear toy, must manage its shot stock wisely. Avoiding wasted resources is crucial; a balanced trial balance showcases effective financial management.

3. Regular Reconciliation Activities

Reconciliation is an accounting necessity often brushed aside. Businesses large and small benefit from periodic reconciliation of accounts. Companies like Mailchimp and Amazon prioritize this practice, identifying discrepancies before they escalate into larger financial issues.

It’s all about accuracy. A regular check ensures stakeholders feel confident in the numbers you’re producing. After all, transparency builds trust, and trust is a cornerstone of any successful business.

4. Implement a Strong Internal Controls System

Internal controls are like the gatekeepers of your financial integrity. Companies that adopt strict procedures, such as dual approvals for significant transactions, help safeguard their trial balance against potential errors and fraud.

Take a page from the playbook of United Parcel Service (UPS). Their attention to internal controls has allowed them to maintain a solid financial footing. Such practices will reflect well on your overall financial statements, leading to better relationships with investors and partners.

5. Train Employees in Financial Literacy

A well-informed team makes informed decisions. Investing in employee training for financial literacy can dramatically affect the accuracy of your trial balance.

Starbucks, a company known for its extensive employee training, empowers its crew with financial tools. Teaching your team to grasp the financial implications of their daily tasks will, in turn, contribute to a clearer trial balance.

6. Use Historical Data for Forecasting

Don’t just look at your current trial balance; delve into the past. By analyzing historical data, you can spot trends and use that insight for forecasting.

For example, when Ford examines past trial balances, they can make informed decisions about future inventory purchases and sales strategies. This proactive stance equips businesses to manage cash flow effectively and adapt their growth strategies.

7. Engage with Business Advisors or Accountants

Sometimes, you need an outside perspective. Partnering with financial advisors can elevate your trial balance accuracy and overall financial strategy.

Companies like Shopify have greatly benefited from consulting with financial experts, ensuring their practices remain current and effective. This collaboration fosters a balanced approach, blending growth aspirations with financial stability.

Transforming Your Business Through Trial Balance Insights

In 2024, businesses aiming for success will understand and embrace the power of trial balance analysis. The benefits are undeniable: technology integration, awareness of shot stock implications, solid internal controls, and an emphasis on financial literacy create a well-rounded financial approach.

Harnessing insights from your trial balance isn’t just about keeping books in order. It’s about leveraging financial clarity to spark innovative ideas and sustain growth in a world where competition comes from every corner. So, start delving into the numbers! The transformation journey is just a trial balance away. Remember, clarity today sets the stage for success tomorrow.

Let’s celebrate the blend of creativity and strategy in our businesses—the wonderful world of Kdrama financing, the artistry of filmmaking, and strategic financial planning can coexist beautifully. Don’t let your trial balance be a mystery; unlock its potential and let it drive your business forward.

For more insights on the latest independent films and industry news, keep an eye on Loaded! Now’s your time to seize control of your financial future and thrive!

This article dives deep into the practical applications of trial balance strategies while seamlessly blending cinematic references. Tailored for filmmakers and industry pros, it presents a clear, engaging narrative that balances information and storytelling for an audience eager to enhance their financial acumen.

Unlocking the Secrets of Trial Balance

What is Trial Balance?

So, you’re curious about trial balances? You’re not alone! A trial balance is a fundamental aspect of bookkeeping that all businesses need to grasp. It essentially ensures that the total debits equal the total credits in your accounts, which is key for identifying errors before preparing financial statements. You might find it interesting to see that, much like the plot twists in the film Happiest Season, where nothing is ever as straightforward as it seems, a trial balance can reveal the unexpected discrepancies within a company’s financial records.

Fun Facts About Trial Balance

Did you know that the concept of a trial balance dates back to the double-entry bookkeeping method of the Italian Renaissance? Think of it like the excitement surrounding the Mission Impossible 4 cast — just as each actor plays their part perfectly to make a thrilling film, each entry in your books is crucial for maintaining accuracy and accountability. And just like how Sakura Succubus attracts an audience with its intriguing characters, a well-prepared trial balance captivates stakeholders by presenting financial reliability.

On another note, business owners often underestimate the power of financial tools. For instance, using a mortgage amortization calculator can help you manage loans and budget more effectively, just as a well-organized trial balance can save you from financial pitfalls. Plus, did you know that major figures like Noel Gallagher have spoken about their unique ways to manage finances behind the scenes? Just goes to show, whether you’re running a business or pursuing a music career, balancing your finances is crucial!

Enhancing Your Understanding of Trial Balance

Building on the importance of trial balances, there’s an entertaining connection to Caso Asunta, a captivating true crime story, which highlights the need for precise records to uncover the truth. Likewise, your trial balance acts as a crucial checkpoint in maintaining the integrity of your financial statements. Additionally, as you may explore narratives in shows like Wonderful World Kdrama, where characters struggle with finance, a trial balance can pave the way for overcoming monetary mistakes and achieving business dreams.

In conclusion, don’t take the trial balance for granted. Dive into its intricacies, and you’ll see how it shapes both the mundane and fascinating aspects of finance. Whether you’re a small business owner or just someone dabbling in accounting, embracing the trial balance can serve you well. Who knows, you might even find some hidden gems, just like how fans of the Saban franchise anticipate their next thrilling installment!